Guided Wealth Management for Dummies

Guided Wealth Management Fundamentals Explained

Table of ContentsNot known Details About Guided Wealth Management Getting The Guided Wealth Management To WorkThe 8-Minute Rule for Guided Wealth ManagementSee This Report about Guided Wealth ManagementThe Facts About Guided Wealth Management Uncovered

For even more tips, see track your financial investments. For investments, pay payable to the item carrier (not your consultant) (super advice brisbane). Routinely check purchases if you have a financial investment account or use an financial investment platform. Giving a financial consultant total access to your account enhances risk. If you see anything that does not look right, there are steps you can take.If you're paying an ongoing suggestions charge, your adviser needs to examine your financial situation and meet with you at the very least once a year. At this meeting, make sure you talk about: any type of adjustments to your objectives, situation or financial resources (including modifications to your earnings, expenditures or assets) whether the degree of risk you fit with has actually changed whether your current personal insurance coverage cover is right just how you're tracking versus your goals whether any type of changes to legislations or monetary items could affect you whether you have actually received everything they guaranteed in your agreement with them whether you need any changes to your plan Each year an advisor must seek your written grant bill you recurring advice charges.

This may take place throughout the conference or electronically. When you enter or renew the continuous cost arrangement with your advisor, they need to explain just how to end your relationship with them. If you're transferring to a new consultant, you'll need to arrange to move your financial records to them. If you need help, ask your adviser to discuss the process.

Not known Facts About Guided Wealth Management

As an entrepreneur or small business proprietor, you have a lot taking place. There are lots of obligations and expenses in running an organization and you definitely don't require another unneeded expense to pay. You require to very carefully think about the roi of any solutions you get to make certain they are beneficial to you and your company.

If you are among them, you may be taking a huge threat for the future of your service and yourself. You may desire to keep reading for a checklist of reasons why working with a monetary expert is beneficial to you and your organization. Running a service contains difficulties.

Cash mismanagement, cash money circulation troubles, delinquent repayments, tax problems and other monetary problems can be vital sufficient to shut a service down. There are lots of methods that a qualified financial advisor can be your companion in aiding your business flourish.

They can function with you in evaluating your economic situation regularly to stop severe blunders and to quickly remedy any bad cash decisions. Many small business proprietors put on lots of hats. It's reasonable that you want to conserve cash by doing some jobs on your own, yet taking care of financial resources takes knowledge and training.

The Buzz on Guided Wealth Management

Preparation A business strategy is important to the success of your service. You need it to recognize where you're going, just how you're getting there, and what to do if there are bumps in the roadway. A good monetary expert can create an extensive strategy to help you run your service much more successfully and get ready for abnormalities that develop.

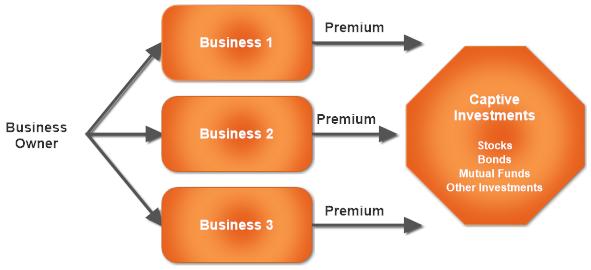

Wise financial investments are vital to attaining these objectives. Most entrepreneur either do not have the know-how or the moment (or both) to analyze and assess financial investment possibilities. A trustworthy and well-informed monetary expert can lead you on the investments that are ideal for your organization. Money Cost savings Although you'll be paying an economic expert, the long-lasting financial savings will validate the cost.

It's all about making the wisest financial decisions to raise your chances of success. They can guide you toward the best opportunities to raise your revenues. Decreased Tension As a local business owner, you have whole lots of points to worry around (financial advice brisbane). A great monetary advisor can bring you comfort understanding that your financial resources are getting the focus they require and your money is being invested carefully.

Unknown Facts About Guided Wealth Management

Security and Development A certified financial consultant can provide you quality and help you focus on taking your organization in the right direction. They have the devices and sources to employ techniques that will certainly ensure your company expands and thrives. They can assist you analyze your goals and determine the very best path to reach them.

Facts About Guided Wealth Management Revealed

At Nolan Bookkeeping Facility, we click here to read offer competence in all facets of monetary preparation for small companies. As a tiny service ourselves, we understand the difficulties you encounter daily. Offer us a call today to go over just how we can help your service thrive and prosper.

Independent possession of the practice Independent control of the AFSL; and Independent remuneration, from the client just, via a set buck fee. (https://pblc.me/pub/3a4bdb1a0985b5)

There are numerous advantages of an economic organizer, despite your situation. In spite of this it's not uncommon for individuals to 2nd assumption their suitability due to their position or existing financial investments. The goal of this blog is to show why everyone can profit from an economic plan. Some common concerns you might have felt on your own include: Whilst it is very easy to see why people may believe in this manner, it is most definitely wrong to regard them remedy.